May Day! Did you find your Best-fit Jersey?

May 1st – National College Decision Day – is a big day for colleges and high school seniors alike. It’s a day of hopes and dreams for the future. This day is always a highly anticipated event but even more so this year as we still battle COVID and decisions are still tainted by the experience. “How COVID will continue to impact college decisions?” is a question on industry experts’ minds. Many decisions, made on May 1st, may have been different if not for COVID. That made this year’s May 1st even more awaited.

As always, students wore the merch of their selected home for the next 2-4 years, announcing their big decision to join a college campus of their choice. But you wonder - will they change the color of their jersey before fall? Will they find a better fitting jersey? And most likely many will. In my personal opinion, finding a better-fit college is a win-win for everyone. If the major and campus match with students' strengths and talents we will reduce the number of times they end up changing their major, which can be a very expensive proposition.

It’s cheaper and better to change their jersey before they set foot on the campus. But the changing of jerseys is not good for colleges who are trying to fill every seat of their freshman class when they can’t be sure if all students who deposited will show up on their campus in fall.

And that is why a huge number of colleges are continuing to recruit for the Fall ‘22 class despite the fact that their deposits are higher than their freshman class enrollment goals.

Macro Trend: An Overall Decline

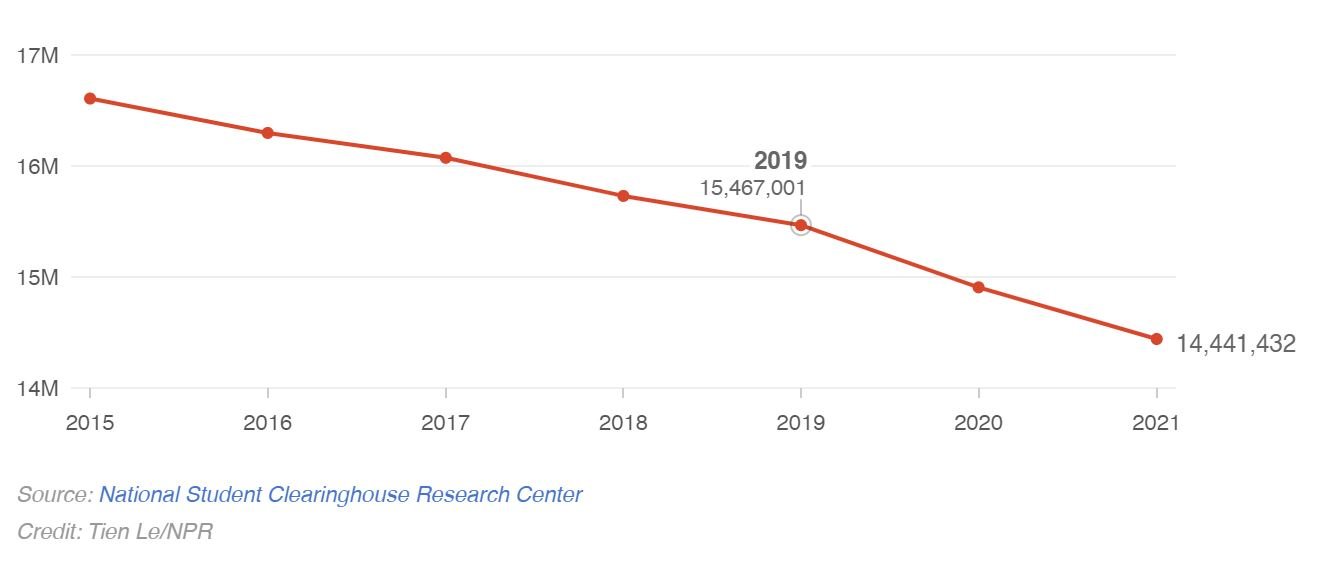

The number of college applications have been up, acceptances are higher, and deposits are higher. So why this panic? Because overall college enrollment has declined significantly in the last two years, a trend that was already in the making. COVID only intensified an old problem as captured in this synopsis of college enrollment history. Which means there are less students to fill the same number of seats in college freshman lecture halls. It’s the reverse musical chairs game.

College Enrollment declined 11% 2011- 2019, another 6% during 2 years of COVID

The Seattle Times recently reported about a 7% enrollment decline across all WA state colleges in the last two years, with some colleges dropping by as much as 28%. This is in spite of the fact that WA state created the most generous Financial Aid program in the country in 2019.

Summer Melt

From now till fall starts, Summer Melt is the big concern for colleges - a process where students change their mind about their choice of college they will join in the fall. Colleges stay concerned about how many of those deposits will actually yield to a full enrollment? How many students will like their jersey and continue with their choice? Colleges can’t just sit back and relax. Their work is not done yet.

Colleges are competing to get students’ attention and hoping that students will pick their campus over their competitions’. With the recent change in NACAC ethics rule, the headache of summer melt has increased. Now colleges can continue to market to the students who are accepted/ deposited in other colleges. The Justice Department believes that poaching by colleges aligns with students’ right to choices. This means that the race among colleges doesn’t stop till the first day of classes in the fall.

Colleges: Pick Me, Pick Me, Pick Me!

Continued Pain: Decline in Transfer Students

On top of all this, last week, a bleak report on Upward Transfers came out. These are students transferring from 2-year college to 4-year college for a bachelor’s degree and other transfers. Transfer enrollment dropped another 6.9 percent over last year, resulting in a 16% enrollment decline over two years since the spring of 2020. It’s not a surprise considering how this aligns with a significant drop in enrollment at community colleges. A drop in Upward Transfers is just the after effect of that decline. This means colleges will have to work harder on growing their freshman class.

Dreaded Future: Enrollment Cliff

All this will result in many colleges falling short on their goals, and hence revenue. The market has seen its fair share of colleges shutting down and/or consolidating in recent history. No one wants to be there.

153 year old Bloomfield College, a small private college in NJ, is seeking financial help to avoid closure next year. Why? Since 2011, enrollment has declined from 2,018 students to 1,598 in 2019. The pandemic worsened everything. There is a dreaded “Enrollment Cliff” predicted for 2026 when enrollment will drop by 15%.

Wake Up Call: Blessing in Disguise

COVID has forced colleges to take a hard look at the antiquated processes and marketing. Sending a flyer to a female candidate as an all-boys college, is not a good use of your limited funds and resources.

Sending paper flyers to a digitally native Gen-Z youth is like trying to sell Kodak films in the digital camera era.

Tech Savvy Generation-Z

Today in 2022 – there is no industry that is paper based and thriving. Everything from newspaper publishing to paper books is on the verge of extinction. Our higher Ed industry cannot be one of those industries.

This is a wake-up call for colleges to do things differently.

Recommendation

Colleges need to understand their target customers (aka Gen-Z students), adapt their techniques and speak a language that their target audience will understand – the language of technology, personalization, and fitting majors with their interest and passions, and so on. Understanding the intersection of students’ passion, strengths, and talents will make higher ed stronger and bolder.

Then let's take one step further - something to think about and continue working on it. Let’s not just focus on filling every seat in every lecture hall, but focus on getting every student graduated from the college campus. A 60% graduation rate nationally is not something to be proud of.

Here is a glimpse of an Ideal Future to strive for:

Make college recruitment like a happy marriage where

students come back the next year (increasing retention more than current 59% average),

they graduate on time (Moving graduation rate higher than current 60% rate),

find a suitable job (reducing 20% unemployment and additional 30% under employment in fresh graduates),

pay off their student debt (getting student debt pandemic under control) and

become a contributing member of society.